Super Deduction

Don’t miss out on extra relief

In April 2023, Super Deduction was replaced with Full Expensing.

On the face of it, this was great news for companies purchasing qualifying assets. However, as per a statement by the Association of Tax Technicians, Full Expensing will be of little benefit to the vast majority of businesses in the UK.

Senga Prior, chair of ATT’s Technical Steering Group, said:

‘’The introduction of Full Expensing will help the UK’s largest companies with investment in plant and machinery of over £1m to obtain immediate relief from tax and will therefore go some way towards compensating for the loss of the Super Deduction.

However, it will do nothing to assist the 99% of companies whose qualifying expenditure on plant and machinery is below that level and for whom the AIA already provides full relief’’

To recap, Super Deduction was introduced in April 2021. Super Deduction gave 130% relief on qualifying costs on Plant & Machinery and was introduced to avoid companies delaying expenditure until April 2023, when the main rate of Corporation Tax increased to 25%. A 130% deduction, at 19% Corporation Tax gives 24.7% relief.

For companies with profits over £250,000, Super Deduction brought tax relief broadly in line with the new published main rate of Corporation Tax of 25%. However, for companies with profit below this level, Super Deduction gives a significant real advantage.

With Super Deduction, those companies with profits below the small profit rate of 19% (below £50,000), qualifying expenditure up to 31.3.23 will have effectively yielded an additional 5.7% of relief. For those with profits between £50,000 and £250,000, marginal relief will apply for periods starting from 1.4.23 and so the additional relief effectively given by Super Deduction before that date will vary.

Many clients will have spent money on qualifying equipment during the period of Super Deduction. For assets such as vehicles, machinery and computer equipment, Super Deduction would have been routinely applied in the accounts. However, where the qualifying items are less obvious and more difficult to identify, such as in the construction or refurbishment of a commercial property, allowances may have been missed.

We have worked on many projects where Super Deduction has been relevant and has provided significant benefits to our clients.

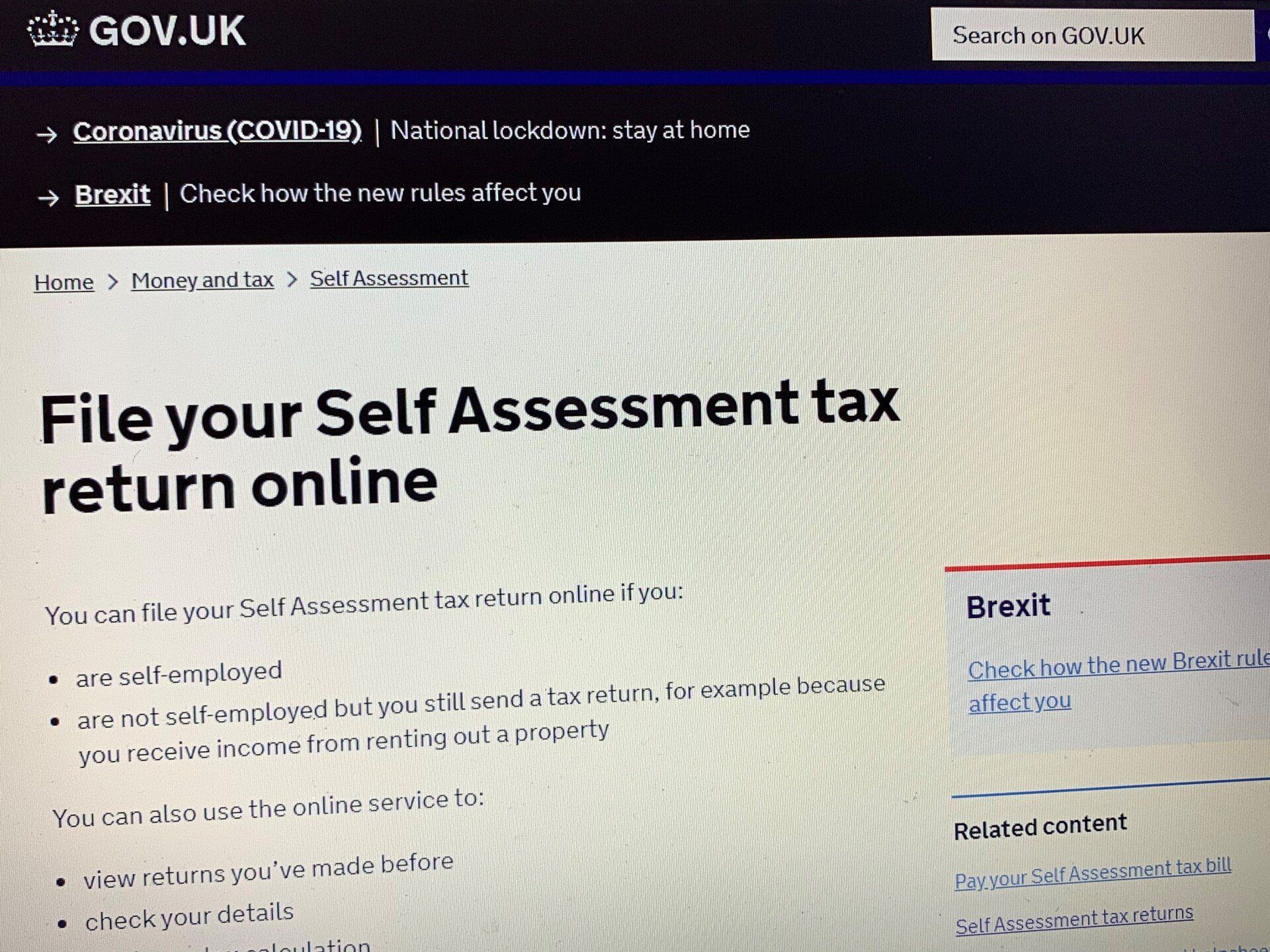

With the removal of Super Deduction in March 2023, it makes sense to review all corporate clients to ensure that any qualifying expenditure for the period 1st April 2021 to 31st March 2023 has been allocated correctly. Similarly, to the availability of Annual Investment Allowance (AIA), if the claim is not made in the year of expenditure, the availability of Super Deduction will be lost and more restrictive Writing Down Allowances will apply on 100% of the expenditure, rather than the enhanced rate of 130%.

If you would like to speak further about this, or believe that you might have clients that would benefit from a review of their expenditure please

contact one of the team.

Key Points

- Super Deduction has a real benefit of an additional tax saving of up to 5.7% for smaller companies.

- Time is running out to amend returns for the Accounting Period where Super Deduction can apply.

- Full Expensing, whilst advantageous for large corporations, spending more than £1m on qualifying assets, it will be of little relevance to most smaller companies as the Annual Investment Allowance will cover most of their expenditure.

- Care must be taken where a company’s financial period ends after 31st March 2023 where hybrid rates of Corporation Tax and Super Deduction may apply.