Fight Back With Capital Allowances

How overlooked tax reliefs can soften the blow of rising employment costs

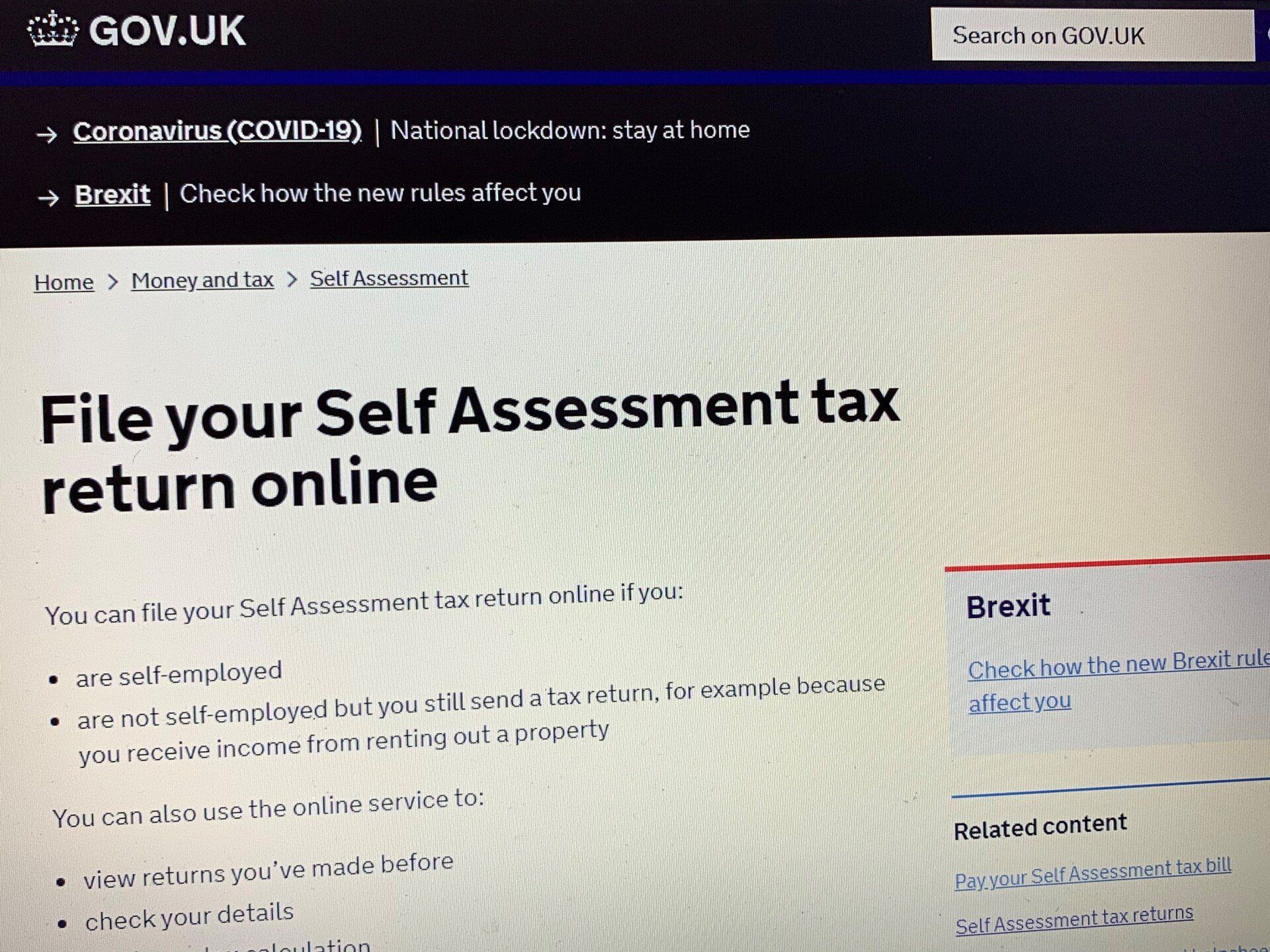

It’s not uncommon to see articles like the one below that caught my eye recently. Increasingly, we are hearing from clients and accountants, that the rise in employment costs are starting to bite.

Cornwall's summer job market shrinks

Hospitality job postings are down 22,369 this summer—a 25% drop from 2024, according to the Recruitment and Employment Confederation (REC). Since the 2024 Budget’s NIC changes, the sector has faced £3.4 billion in extra annual costs, resulting in 84,000 job losses. Neil Carberry, chief executive of the REC, has warned “We cannot keep loading new costs onto employers if we want vibrant high streets and strong local economies.” A government spokesperson said the government was “determined to… drive up growth and opportunity in every corner of the country”.

BBC News (Jonathan Morris and Martha Dixon)

Fight back with Capital Allowances

It’s not just the hospitality industry that is grappling with the additional cost of increased corporation tax rates and higher employment costs. An employer currently paying National Insurance on an employee earning £20,000 has seen their NIC bill rise by £745.80.

Making sure that all reliefs and allowances are claimed is now more important than ever. Whilst these reliefs do not help mitigate the increase in National Insurance costs, they do reduce the burden of Corporation and Income Taxes helping fund the additional costs.

Capital Allowances will routinely be claimed for equipment or vehicles used within businesses. However, capital allowances for commercial properties owned by the business can often go unclaimed.

Where a business owns commercial property, whether the property is occupied for use within the trade or leased to a third party, capital allowances may be available. Ensuring that any allowances are identified could be the difference when making future staffing decisions.

There is generally no time limit on claiming capital allowances. Even where a property has been owned for many years, it is possible to go back and claim capital allowances from when the property was acquired or constructed.

Below are two examples of recent claims which highlight the value of allowances on properties purchased many years ago or where a claim is restricted due to prior claims.

Example 1

We recently carried out a claim for a small pub in Bristol that had been purchased in 2008. The property had been cosmetically refurbished since acquisition and this expenditure had been dealt with as repairs.

The property was purchased for £330,000 and allowing for the items that had been replaced, our analysis determined that there was approximately £59,000 of the purchase price that could be attributed to fixtures.

This gave a first-year tax saving of £1,625 which would contribute to the increased Employer NI costs of 2 employees earning £20,000! The allowances would continue to be written down giving savings for many years to come.

Example 2

Another recent claim was for a Care Home in Gloucester which was purchased this year for £1.3m. The claim was restricted due to claims made by the prior owner.

We identified around £141,000 of allowances which gave the company over £35,000 in first year tax savings by using the Annual Investment Allowance. Equating to the increased NI costs for 47 employees earning £20,000 each!

If you have clients that own commercial property, we can give a free appraisal of the capital allowance position and fees only become payable when allowances are identified and our report is issued.