Furnished Holiday Lets

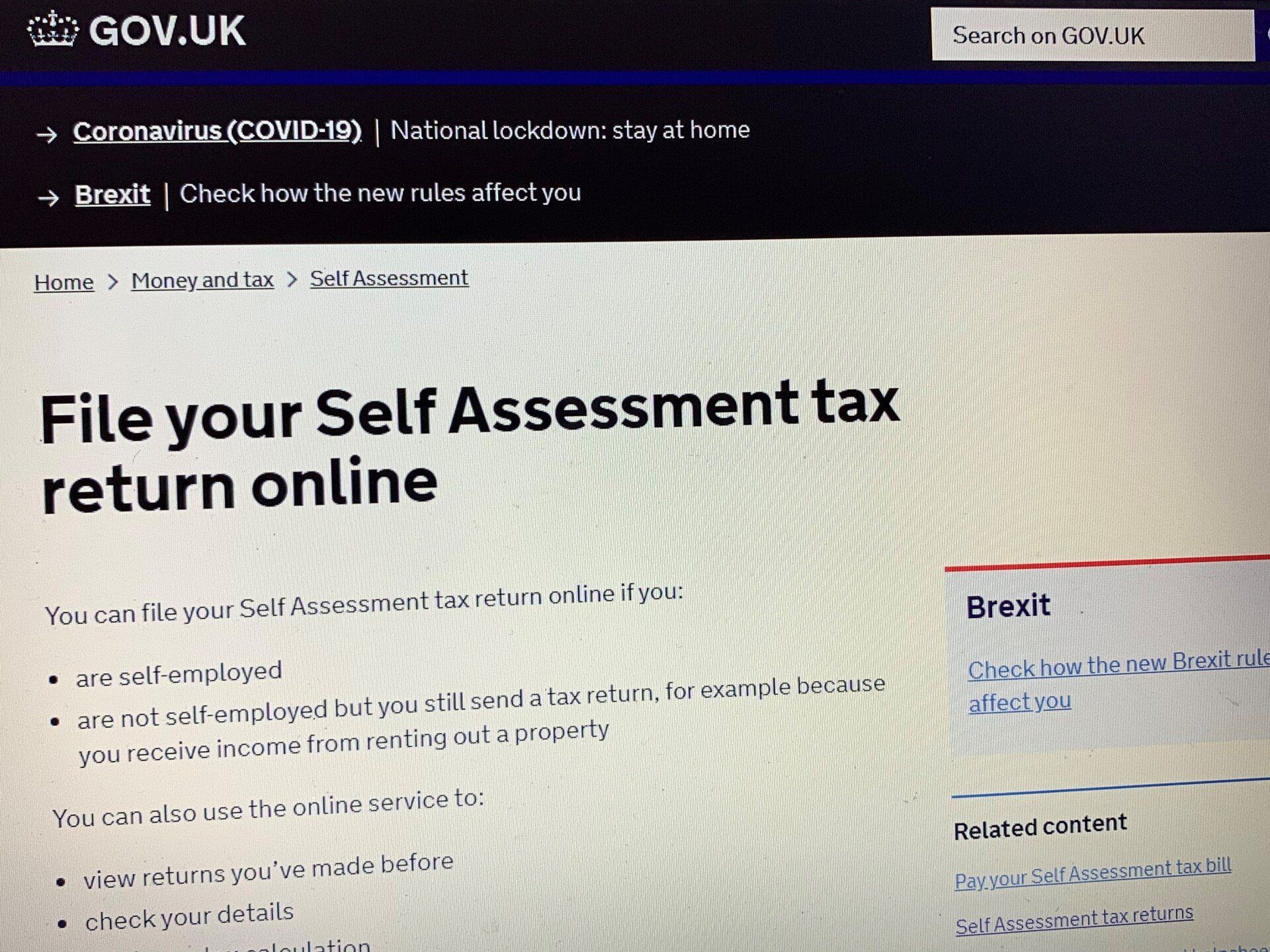

Valuable Tax Relief for Holiday Rentals

With international travel restrictions in the UK being more onerous for holiday makers, more and more are choosing to holiday at home in the UK.

This has been a boon to the Furnished Holiday Let (FHL) market where more property owners are finding that letting their second home is creating a sizeable profit.

Historically, whilst Capital Allowances have been available on FHL’s, for many, the profit levels have not justified claiming the Capital Allowances as they can only be used against the profit of the holiday let business and not used sideways against other income like most other Capital Allowances. However, since the start of the pandemic, with nightly rates and occupancy levels on the increase, claiming Capital Allowances has become ever more important.

To qualify as a Furnished Holiday Let for Capital Allowances purposes, certain criteria must be met: -

· The property must be available for letting for a minimum of 210 days per year

· The property must be let of 105 days per year

· Periods of 31 days or more are not counted

· The property must be situated in the UK or European Economic Area

The rules are in place so that only genuine FHL’s receive the benefit of Capital Allowances and not just second homes that are let on an ad-hoc basis. The rules allow for the above qualification criteria to be averaged over multiple FHL’s under the same ownership.

Over the last few months, we have seen a stepped increase in the number of holiday lets that we have been asked to survey. Here are just a few of the properties where we have identified valuable tax relief:

The View - Ilfracombe

theviewilfracombe.com

It is not uncommon to find between 20-35% of qualifying costs available as tax relief for Furnished Holiday Let owners.

This means that owners can pay little or no tax on many years of rental profits.

To find out more, please contact one of the team.