When Capital Allowances go wrong!

Steve Brown • February 11, 2021

How HMRC intended the FA2012 rules to really work

We are increasingly encountering cases where the rules introduced in the Finance Act 2012 are having a greater adverse impact.

We are now over 6 years past the date when the new rules for transferring allowances between seller and buyers came fully into force so let’s have a brief recap.

In most cases, for properties purchased prior to 2014, for a buyer to claim capital allowances on the fixtures to a property, they must establish whether a prior claim had been made by the previous owner and any previous owner since 1997. This was usually carried out by the client’s advisers who would trace back through the property history and available documentation. In most cases, due to poor historical advice, a claim for the new owner was likely and still is for properties purchased prior to April 2014.

However, since 2014 where the seller had an entitlement to claim allowances, the requirements of FA2012 must be satisfied in order that the buyer may be able to claim them. This means that the vendor must Pool the expenditure into their tax computations (the Pooling requirement) and then pass the allowances to the buyer by way of an election (the fixed value requirement). The rules apply whether the seller had made a claim or not, even if they were unaware of the potential for allowances themselves.

Where the requirements of FA2012 are not satisfactorily dealt with during a property purchase, allowances can now be lost forever, which is unfortunately often the case.

Example

We have recently analysed a portfolio that included 7 properties, which were purchased for a total of more than £7.5m. Each of the properties had changed hands since 2014 and had been purchased from a seller who was entitled to claim capital allowances. Therefore, the FA2012 rules applied in all cases.

- Whilst it appeared on initial analysis that there had been very little in terms of prior claims by previous owners, our client was out of time to go back to satisfy the requirements of FA2012 and get the allowances passed to them by the various sellers.

- All but one of the properties had been purchased by the previous owner after April 2008 when the Integral Features legislation was introduced and so even a top up claim was not possible. For the property where a top up claim was made, approximately £60,000 of allowances were identified. For examples of top up Integral features claim, see the ‘Restricted Claims’ section in our Gallery on our website.

- Had this client taken capital allowance advice upon the purchase of each property, it is not unreasonable to estimate that allowances would have been somewhere in the order of £1 million or more.

Whilst this is possibly the most extreme case of lost allowances that we have come across, we have seen a number of cases similar to the one above and believe that unless more clients are offered capital allowance advise when either buying or selling a property, more allowances will be lost forever….exactly as HMRC intended when they introduced the rules in 2012.

We can help you and your clients maximise their entitlement to claim allowances, whether they are buying or selling a commercial property. Even clients who have owned commercial property for some time should ensure that allowances have been fully identified.

For more information please do get in touch with one of the team.

It was announced during the budget speech back on 6 th March 2024 that the Furnished Holiday Let (FHL) regime would be abolished with effect from April 2025. At the time, no rules were announced as to how the transition for businesses would work. After a long wait, The Chancellor, Rachel Reeves has now announced the draft measures to be introduced for the abolition of Furnished Holiday Lettings Relief. In summary, Furnished Holiday Lettings benefit from several beneficial tax treatments compared to other property businesses: No restriction of finance costs (Residential landlords are restricted to loan interest at the basic rate of Income Tax). Capital Allowances are available on qualifying expenditure. Access to reliefs from taxes on chargeable gains for trading business assets. Earnings from FHL’s are relevant income for pension purposes. For the qualification rules for FHL’s, please see our previous blo g . For the remainder of this article, we will focus on the changes to capital allowances only. After repeal, former FHL’s will form part of the person’s UK or overseas property business and be subject to the same rules as non-FHL property businesses. For new expenditure, on or after 1 st April 2025 for Corporation Tax and 6 th April 2025 for Income Tax, no capital allowances will apply. However, there is some good news for existing Holiday Let owners. The Good News Where an existing FHL business has an ongoing capital allowance pool of expenditure, they can continue to claim writing down allowances on that pool. However, any new expenditure after April 2025 will not benefit from capital allowances. Under current rules, a loss generated from an FHL property business can only be carried forward and utilised against future profits of that same FHL business. After the changes, former FHL properties will be part of the persons UK or overseas property business. That property business will then include the amalgamated profits and losses of all the properties in that business. Key Points FHL’s will form part of a person’s UK or overseas property business from April 2025. Capital allowance pools as of April 2025 can continue to be written down. Losses on FHL businesses will form part of the normal UK or overseas property business. A client example Our client owns a FHL in Devon and has met the qualifying criteria. The property was purchased in the 2021/22 tax year for £500,000. Whilst trading was good in the first few years, other expenses, such as soft furnishings, meant that very little profit was made in 2022 and 2023. A capital allowance exercise was carried out on the property and £123,000 of allowances were identified. These allowances were fully utilised in the year of purchase by allocating them to the Annual Investment Allowance and creating a significant loss to carry forward. Under the current rules, this loss could only be used against future profits from the FHL business. After 6 th April 2025, this loss will be able to be offset against profits from the client’s other property income. More example claims can be found on our Furnished Holiday Lettings blog . For more information, please contact one of the team.

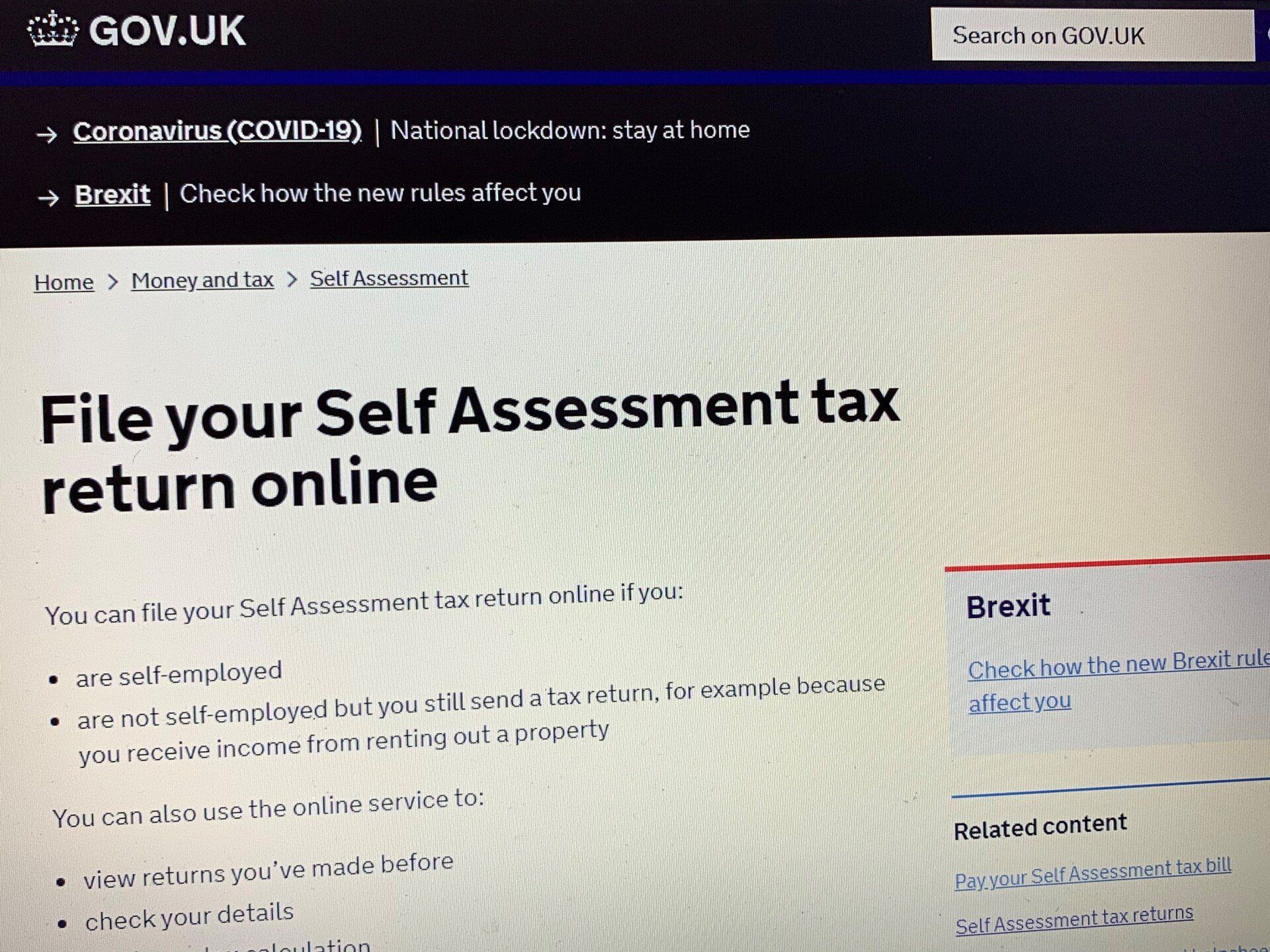

In a late move, that will no doubt bring joy to many accountants and tax advisers, HMRC have announced that the deadline for submitting self-assessment tax returns has been extended from 31st January 2021 to 28th February 2021. This extension is expected to help more than 3 million people, that are yet to have submitted their returns, avoid receiving a penalty for late filing. We have managed to get ourselves ahead of the game at Elemental Tax and our last January case was issued today, Wednesday 27th. However, with the new deadline of the 28th February, any individuals with personally owned property can still submit their tax return until the end of February and reduce the tax payable to HMRC. Even those who have already submitted their return can still amend their tax returns in the normal way through to 31st January 2022 and receive a refund of tax that has just been settled. The government said it was still encouraging people to file by 31 January if possible, adding that taxpayers were still obliged to pay any tax that they owe for the year by 31 January and that interest would be applied to any outstanding balance from 1 February. However, if capital allowances are available, tax liabilities can be reduced, sometimes to zero giving the ability to avoid any interest payments altogether. Over the last few months, Elemental Tax have uncovered more than, £3.5 m in capital allowances which resulted in more than £1m in tax savings for our clients. Over that period, we have analysed properties and portfolio held by companies, partnerships and individuals ranging in costs from as low as £25,000 to more than £4m. It is rarely too late to go back to assess a property acquisition, construction or refurbishment to see if capital allowances are available. January and now February is the ideal time to consider capital allowance claims for clients who own commercial property in their own name or via a partnership. Key takeaway’s • Capital Allowances are a valuable form of tax relief. • The higher the marginal tax rate paid the bigger the benefit. • Allowances are of greater benefit to individual owners who pay tax at rates of 40% or even 45% (41% and 45% in Scotland). • It is also possible to regain personal allowance lost if income is reduced below £125,000, resulting in an effective tax saving of up to 60% in some cases. • It is rarely too late to go back and analyse historic costs. • Contact Elemental Tax if you or your client’s own commercial property and are yet to make a claim.

On the 12th of November the Government announce an extension to the temporary increase in the Annual Investment Allowance (AIA) through to 1st January 2022. The AIA was originally increased from £200,000 to £1 million for the period between 1st January 2019 and 31st December 2020 and was due to revert to £200,000 on 1st January 2021. However, to further stimulate the economy through the ongoing pandemic, the £1 million limit has been extended to 1st January 2022. The AIA is a valuable benefit which accelerates the use of capital allowances. This could range from buying a piece of equipment for your trade to the allowances available on fixtures to a commercial property that was built, bought, extended or refurbished in the current year. This is a welcome extension and recognises the need to stimulate the economy through this uncertain period and generating valuable tax relief when it is most needed. For more information on ‘Making the most of the Annual Investment Allowance’, please see our previous blog. Financial Secretary to the Treasury Jesse Norman said: ‘’It is vital that we support business through the difficult months ahead.’’ ‘’Extending the Annual Investment Allowance’s £1 million cap will give businesses the confidence they need to invest into next year, helping them to grow whilst benefitting the wider economy too.’’ As part of today’s announcements, the government is also delivering on its commitment to help protect UK taxpayers through clamping down on promoters of tax avoidance schemes. This emphasises the importance of legitimate tax planning such as capital allowances and maximising relief wherever possible.

Capital allowances are a form of tax relief that are designed to encourage investment in assets which lead to economic growth. Usually the allowances are given over the perceived life cycle of the asset in the form of writing down allowances (WDA's). The Annual Investment Allowance (AIA) accelerates the way in which allowances can be used and in many cases allows the entire cost of the asset to be offset in the year of purchase.