The value of a survey

The value of a survey

A lot like buses, things in business tend to occur more than once in a short space of time. We have recently been reminded about the importance of a survey and why it plays a vital role in how we add value for accountants and their clients.

‘My property is just a basic shell’

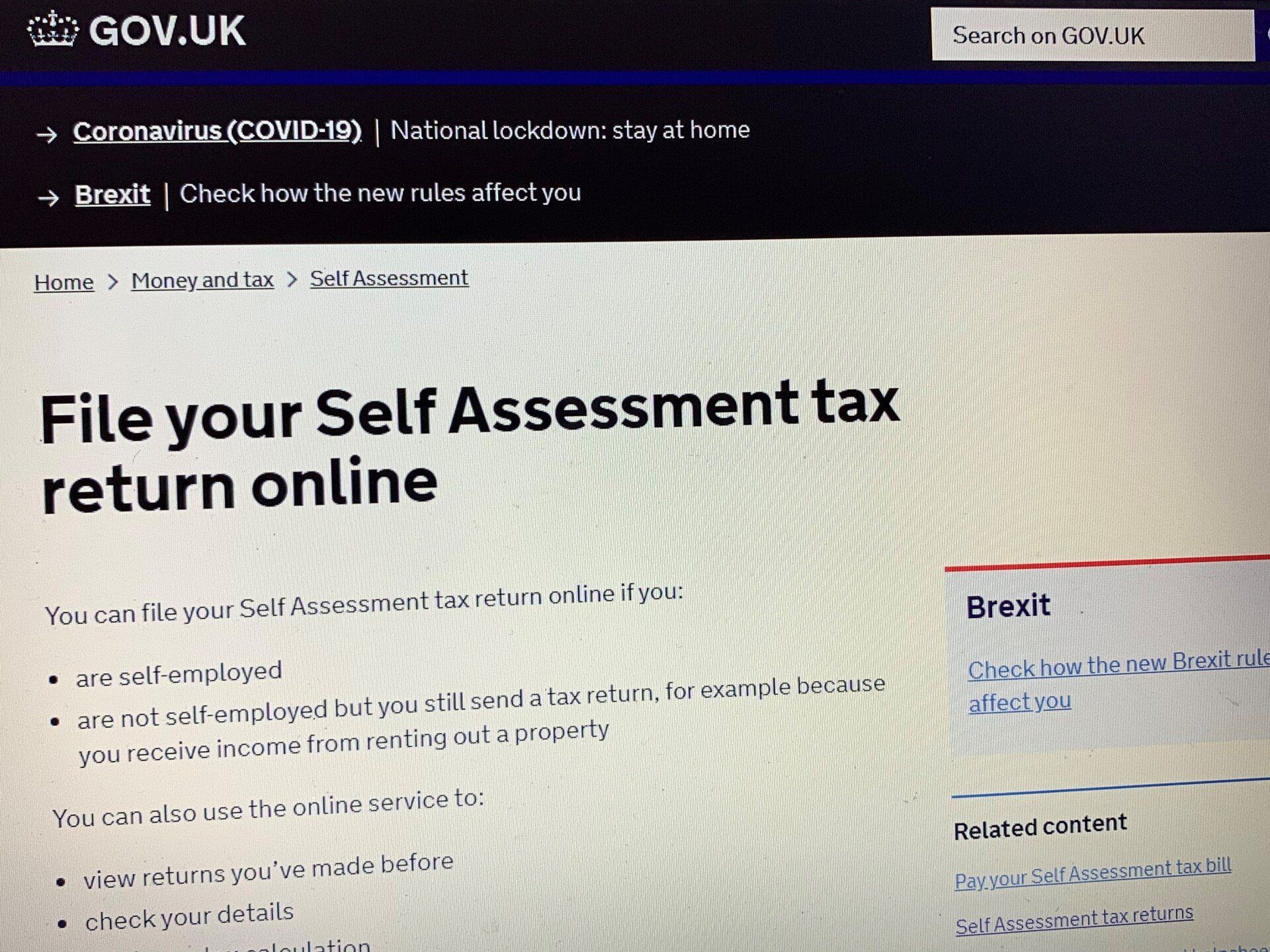

Recently, we discussed a case with a partner from a regional office of a national accountancy firm. It highlighted to us the importance of offering a full service and which is why we survey every property that we evaluate. (Note: We do have procedures where we can remotely survey a property. However, this is only used where a full site visit is impossible).

The firm in question has an in-house capability for capital allowances work, especially where cost information for new build and refurbishment work is known and broken down. However, they like many, appreciate that they may need assistance where costs are unknown or more importantly, where a property changes hands and an apportionment exercise is required.

The case involved a client who had recently sold a unit, which they had acquired new from a developer, a few years ago as a ‘warehouse shell’. When the client was taken on by the adviser, they were asked about whether there was scope for allowances and were insistent that it was ‘just some walls and a roof’.

The client installed a lot of air conditioning, lighting etc. which the accountant claimed for. This was protected on sale by a s.198 election.

The purchaser employed capital allowance expert who identified items which had not been claimed for by the seller, that were part of fabric of the original ‘shell’ – a lift, toilets, wiring etc.

One thing that we can say for certain is that is very rare for a building to be ‘just a shell’. We have visited properties in the past where claims are difficult to justify on the basis that they are a basic unit with a roller shutter door, a waste stack in the corner with the mains electrical box at the entrance. However, these are unusual. More often, there are electrical systems, lighting (or wiring for lighting), plumbing etc. There can be a lot of value in these ‘hidden’ assets.

Had a survey taken place for the client above, it would have become apparent that the building was more than just a shell and given that it included a lift, it is not unreasonable to think that the claim for the acquisition alone could have amounted to 15% of the purchase price or more.

Construction costs are often not clear

In another recent case the value of a survey was again in evidence.

We were asked by an accountant client to review some expenditure in a clients fixed asset register which consisted largely of ground works. Much of the obvious plant and machinery had already been attributed to Plant and Equipment by the company’s accountant.

Upon survey, we observed a large wash down bay for industrial vehicles, the client is a plant hire company. Further inspection and analysis of the fixed assets confirmed that there was no mention of the wash down bay.

The upshot was that the wash down bay accounted for £45,000 of the ‘ground works’ which would have gone unclaimed had a survey not taken place.

For further information or to discuss an ongoing or historic project, please contact one of the

team.