There's still time to make a claim for FHL owners

It was announced during the budget speech back on 6th March 2024 that the Furnished Holiday Let (FHL) regime would be abolished with effect from April 2025.

At the time, no rules were announced as to how the transition for businesses would work.

After a long wait, The Chancellor, Rachel Reeves has now announced the draft measures to be introduced for the abolition of Furnished Holiday Lettings Relief.

In summary, Furnished Holiday Lettings benefit from several beneficial tax treatments compared to other property businesses:

- No restriction of finance costs (Residential landlords are restricted to loan interest at the basic rate of Income Tax).

- Capital Allowances are available on qualifying expenditure.

- Access to reliefs from taxes on chargeable gains for trading business assets.

- Earnings from FHL’s are relevant income for pension purposes.

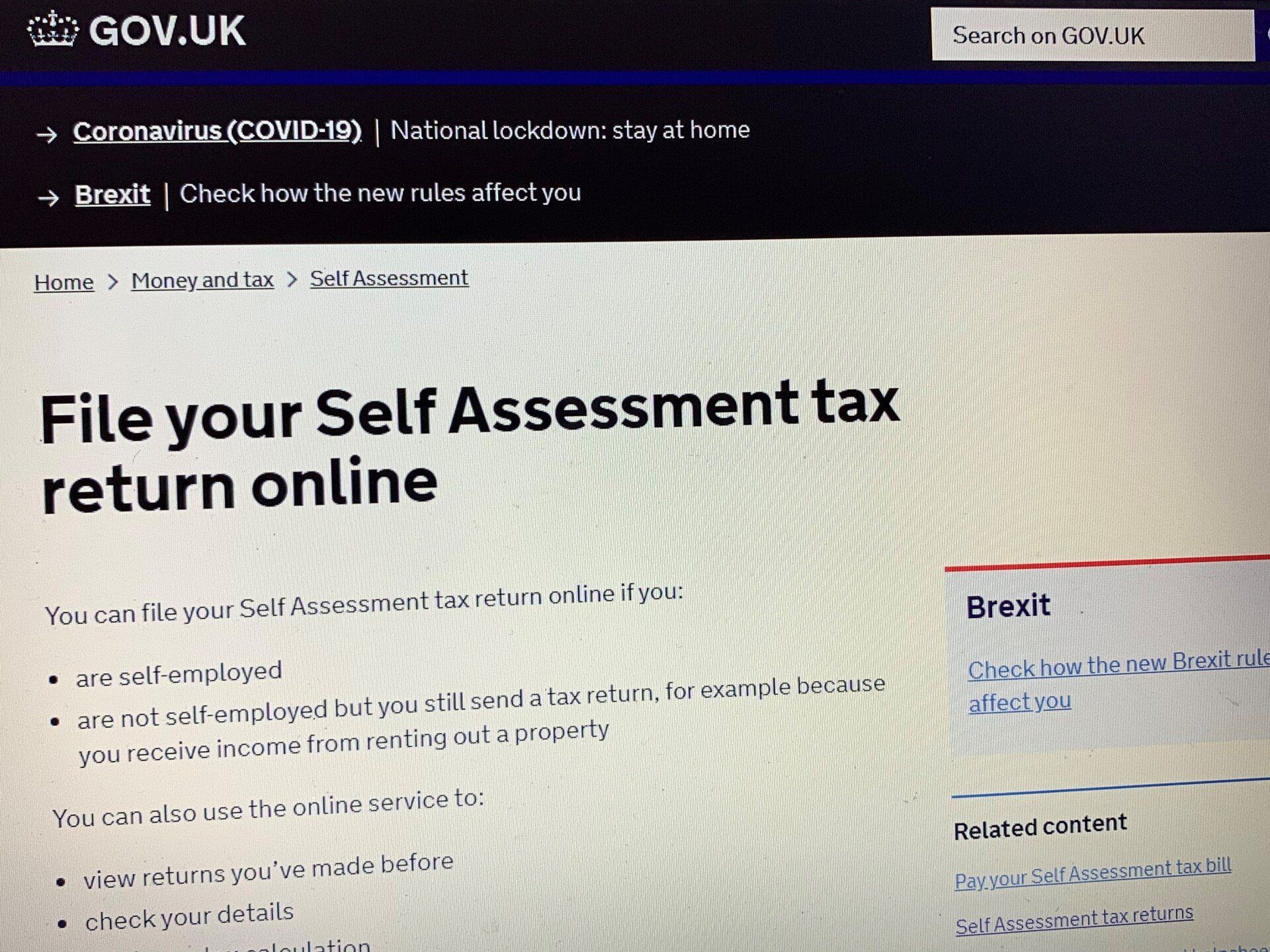

For the qualification rules for FHL’s, please see our

previous blog. For the remainder of this article, we will focus on the changes to capital allowances only.

After repeal, former FHL’s will form part of the person’s UK or overseas property business and be subject to the same rules as non-FHL property businesses.

For new expenditure, on or after 1st April 2025 for Corporation Tax and 6th April 2025 for Income Tax, no capital allowances will apply. However, there is some good news for existing Holiday Let owners.

The Good News

- Where an existing FHL business has an ongoing capital allowance pool of expenditure, they can continue to claim writing down allowances on that pool. However, any new expenditure after April 2025 will not benefit from capital allowances.

- Under current rules, a loss generated from an FHL property business can only be carried forward and utilised against future profits of that same FHL business. After the changes, former FHL properties will be part of the persons UK or overseas property business. That property business will then include the amalgamated profits and losses of all the properties in that business.

Key Points

- FHL’s will form part of a person’s UK or overseas property business from April 2025.

- Capital allowance pools as of April 2025 can continue to be written down.

- Losses on FHL businesses will form part of the normal UK or overseas property business.

A client example

Our client owns a FHL in Devon and has met the qualifying criteria. The property was purchased in the 2021/22 tax year for £500,000. Whilst trading was good in the first few years, other expenses, such as soft furnishings, meant that very little profit was made in 2022 and 2023.

A capital allowance exercise was carried out on the property and £123,000 of allowances were identified. These allowances were fully utilised in the year of purchase by allocating them to the Annual Investment Allowance and creating a significant loss to carry forward.

Under the current rules, this loss could only be used against future profits from the FHL business.

After 6th April 2025, this loss will be able to be offset against profits from the client’s other property income.

More example claims can be found on our

Furnished Holiday Lettings blog. For more information, please contact one of the

team.